- Get link

- X

- Other Apps

Getting that interest rate down will save you money and enable you to get out of debt more quickly. Understand your debt problem.

How To Pay Off Credit Card Debt Fast Once A Week Blog

How To Pay Off Credit Card Debt Fast Once A Week Blog

There are a couple of options for getting your credit card interest rates lowered.

How do i get out of credit card debt fast. One simple way to make a huge impact is to pay double the minimum. A good place to start is to shift your debt to a credit card that offers a 0 balance transfer card deal. I managed to pay off 80000 in auto credit card and student loans debt in just over three years.

You open a new credit card that has a period of 0 interest. Yes you CAN get out of debt. What makes credit card debt particularly evil is the insanely high interest rates.

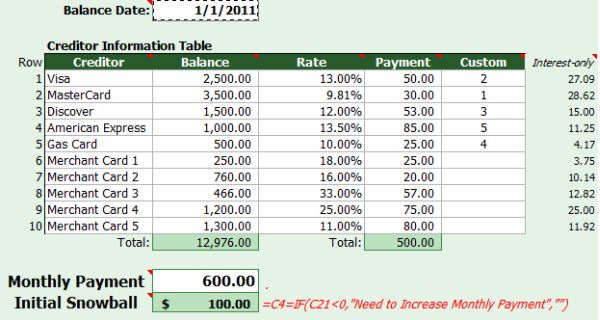

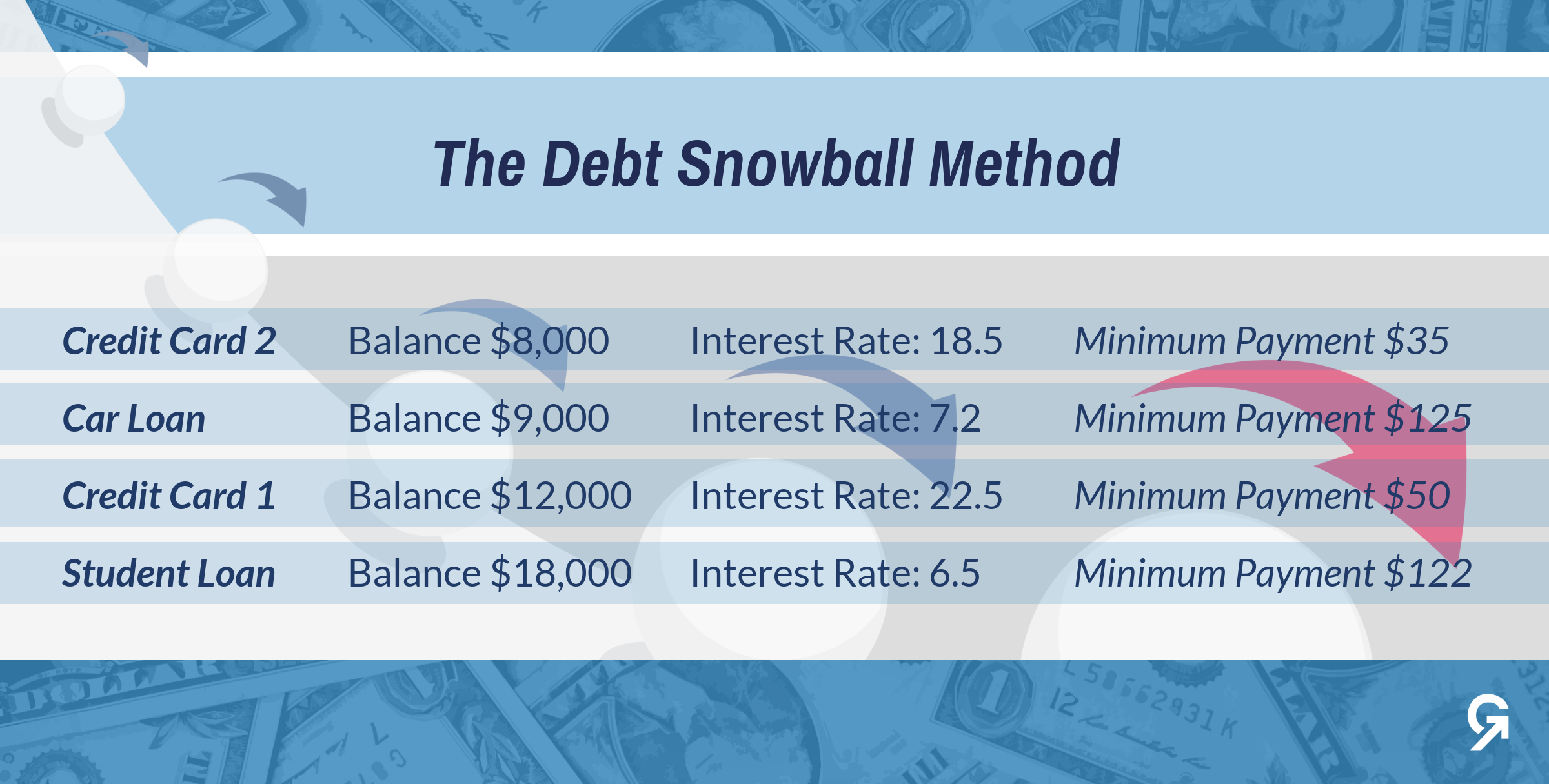

Say you owe 2000 on a credit card with a 20 APR and a 40 monthly minimum payment. Step 4 Request lower interest rates on your credit cards. With the snowball method youd pay off the card with the 700 balance first.

If you have more than one credit card debt prioritize putting the extra money toward the ones with the highest interests. A good first step toward getting out of credit card debt is to assess your financial situation. Pay off the loan with the highest interests rate or use the debt snowball method.

Look through every line item on your budget and get rid of the expenses you dont absolutely need. I know how to get out of debt and I know you can do it too. 2 First you need to list down all the credit card debts you have in the order of their interest rates.

This debt pay-off strategy known as the debt avalanche method is essential for being debt-free quickly. And it starts with a few strategies that will help you quickly get out of credit card debt. This review of your overall debt should include the balance and the annual percentage rate or APR the price youre charged to borrow money for each credit card.

Pay off highest interest rate credit cards first I organized the spreadsheet by highest interest rate credit card to lowest. If you are committed to getting out of credit card debt quickly you should not make any new charges. I could now see the full picture of the problem and we both got on board with making every effort we could to pay off the debt.

Cut up your credit cards or put them in a safe storage space. Develop a payment plan. Counselors negotiate new terms with your creditors and consolidate your credit card debt.

In the above scenario even if you were to pay 400 a month on the bill and refuse to put any more debt on the card it would take you a little over 2 12 years to pay off your credit card debt. If your credit card debt is a mountain then climb that mountain by learning how to pay off 20000 in credit card debt. Then take all of the money you save and put it toward credit card debt.

Hide your credit cards and pay cash. Another great way of reducing your debts is to cut the interest payments. Then youd move on to the card with the 1500 balance and youd pay off the one with the 4000 balance last.

Here are 9 rock solid steps to get you up and runningit doesnt matter if the debt is 20k 100k or anything above and beyond. Consider a low rate balance transfer card. The key to secure financial footing is responsible debt management.

To recap you should utilize the following strategies when paying off your credit card debt. Create a list of everything you owe including credit card debt and all other monthly bills. Budget for debt repayment.

If you have a 10000 credit card with an 18 interest rate you are going nowhere fast. You may not feel theres room in your budget to make larger credit card payments but if youre serious about being debt-free youve got to make some changes. Some offer that rate for as long as 24 months.

The best option is a balance transfer credit card. Another way to get more money to pay off your debt quickly is to sell your stuff. There are dozens of apps you can use to sell your stuff online and locally.

Your credit accounts may be closed and you. Find out how much debt you REALLY have this tool can help Step 2. Youll then pay the counseling agency a fixed rate each month.

Create additional streams of income. Say you have three credit cards with balances of 700 1500 and 4000. Continue until all your credit card balances have been paid in full.

Find out your credit score and monitor it closely. If you could find an. After my initial panic subsided I knew this was a step in the right direction.

Use a personal loan to pay off credit card debt. By doing this you will be able to stop paying interest and tackle the actual debt itself. As a debt junkie for almost ten years I ran up credit card after credit card living like my salary was about four times its actual size.

Freeze your credit card debt literally to stop it from growing. But when we incur too much debt the financial stress that comes with it can outweigh the benefits. My credit card had a 19 percent interest rate which is very common.

Start With High-Interest Credit Card Debt. Five ways to reduce or eliminate debt. To free up cash to pay down your credit card debt you must try to cut your costs increase your income or both.

5 Credit Card Debt Pay Off Tips To Get Out Of Debt

5 Credit Card Debt Pay Off Tips To Get Out Of Debt

How To Pay Off High Interest Credit Cards Fast

How To Pay Off High Interest Credit Cards Fast

How To Get Out Of Credit Card Debt Fast 5 Step Pay Off Plan

How To Get Out Of Credit Card Debt Fast 5 Step Pay Off Plan

5 Smart Ways To Get Out Of Credit Card Debt Fast

How To Get Rid Of Credit Card Debt Fast 5 Step System Credit Score

How To Get Rid Of Credit Card Debt Fast 5 Step System Credit Score

Get Out Of Credit Card Debt Fast Tubofcash Over Blog Com

Get Out Of Credit Card Debt Fast Tubofcash Over Blog Com

How To Pay Off Credit Card Debt Fast 5 Foolproof Strategies Get Out Of Debt

How To Pay Off Credit Card Debt Fast 5 Foolproof Strategies Get Out Of Debt

How To Get Rid Of Credit Card Debt Fast 5 Step System Swift Salary

How To Get Rid Of Credit Card Debt Fast 5 Step System Swift Salary

Best Way To Eliminate Credit Card Debt Fast

Best Way To Eliminate Credit Card Debt Fast

Credit Card Repayment Strategy Paying Off Credit Cards Credit Cards Debt Credit Debt

Credit Card Repayment Strategy Paying Off Credit Cards Credit Cards Debt Credit Debt

How To Pay Off Credit Card Debt Faster

How To Pay Off Credit Card Debt Faster

How To Pay Off Credit Card Debt Fast Credible

How To Pay Off Credit Card Debt Fast Credible

11 Steps To Kill Credit Card Debt Fast Creditcardgenius

11 Steps To Kill Credit Card Debt Fast Creditcardgenius

3 Ways To Pay Off Credit Card Debt Fast The Frugal Millionaire

3 Ways To Pay Off Credit Card Debt Fast The Frugal Millionaire

Comments

Post a Comment